How to Avoid This Big S&P 500 Financial Mistake

I’ve held 401(k) or 403(b) retirement optimization workshops with many of you to educate and empower you to make financial decisions that are in your best interest. As Suze Orman says, there is no one who cares about your financial future more than the person in the mirror.

One of the key concepts that we discuss during these workshops is the S&P 500 and the high cost of trying to time the market. Investors often make decisions based on emotions. They may buy when a stock price is too high only because others are buying it. Alternatively, they may sell on one piece of bad news. For these reasons, most investors who are trying to time the market end up underperforming the broad market. I want to share with you how to avoid this big financial mistake.

Time in the market — not timing the market — is what matters.

In this article I wanted to share with you how much you can lose by trying to time the market. Your best bet is to set a long term investment strategy and leave it, no matter what is going on in the market. Let me share some data points with you.

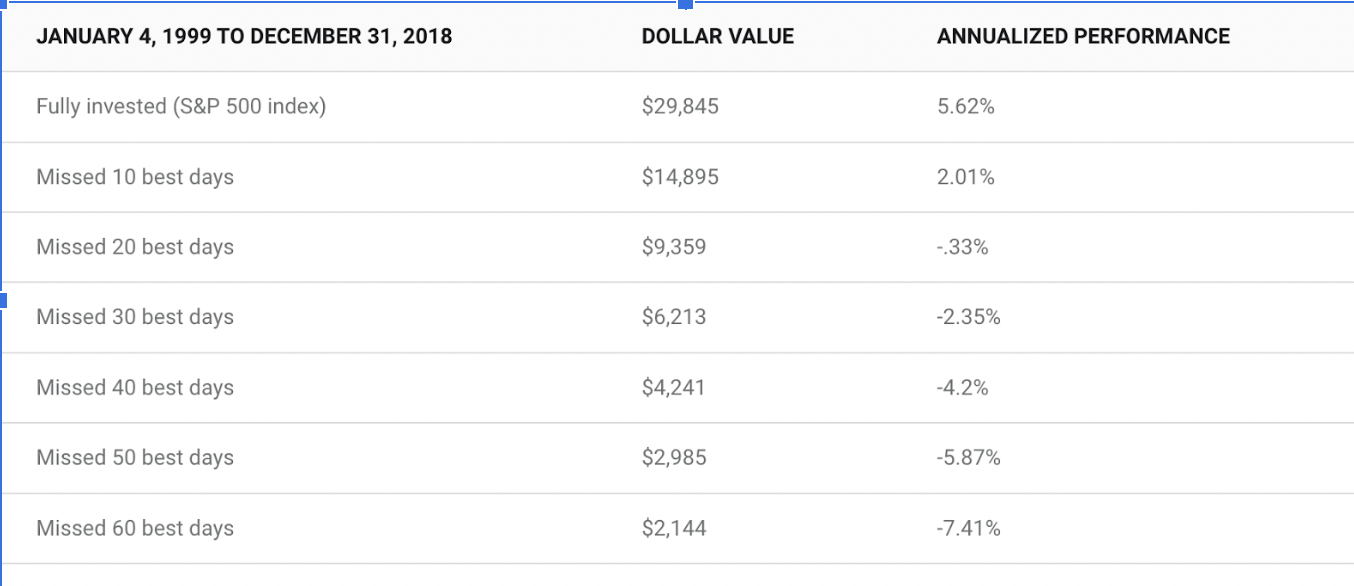

JPMorgan Asset Management's 2019 Retirement Guide shows the impact that pulling out of the market has on a portfolio. Looking back over the 20-year period from January 1, 1999, to December 31, 2018, if you missed the top 10 best days of the S&P 500, your overall return was cut in half. That's a significant difference for only 10 days over two decades!

Here's how a $10,000 initial investment in the S&P 500 fared over the past 20 years, depending on whether its investor stayed invested or, instead, missed some of the market's best days.

It is especially important to maintain a disciplined investing approach when markets take a dip. If you fall prey to the temptation of selling out of your investments when the market dips, you may be doing more harm over the long run.

Once you are out of the S&P 500, there is a good chance you may miss the upswing when the markets rebound. They will at some point because markets are cyclical.

Most people who sell during a downturn tend to buy back into the market when it is too late and the markets have already rebounded. At that point, an investor has missed the opportunity to recoup their losses.

There’s always something to be worried about.

In 2020, investor worries centered on COVID-19 and the U.S. presidential election. In 2021, there were new variants of COVID-19 and China’s simultaneous property market turmoil and regulatory crackdowns. Today, it’s hot inflation, central bank policy tightening, the Russia/Ukraine conflict… What’s next?

I love the table below, both because it’s helpful in remembering much of what investors have been through, and also because it emphasizes the mantra of “this too shall pass.” This chart shows the cumulative total returns from the December 31 of the year before this event to January 31, 2022. For example, the S&P 500 index has returned 415.4% from the December 31 before September 11, 2001 (December 31, 2000) to January 31 2022

Your best bet is to set a long term investment strategy and leave it, no matter what is going on in the market.

NOT FINANCIAL ADVICE

The information contained in this article is for informational purposes only and shall not be understood or construed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be. I do not accept any fees or commissions from anyone or any financial institution.

I’d love any feedback on these articles.