Why Are Teachers So Vulnerable to Financial Predators?

K-12 Teachers are especially vulnerable to unknowingly buying high-fee, high-commission financial products sold as “Guaranteed Income” and “Risk Free” but are really called annuities. They are sold these annuities by predatory salespeople masquerading as “Financial Advisors” who show up in their lunchroom. This may quite literally cost teachers their futures, and most aren’t even aware of the impact of their decisions until it’s too late.

Many school districts supply a list of scores of vendors, with brands that are hardly recognizable. Overwhelmed and unsure about which option is best, teachers tend to take the bait and select the options that have had representatives patrolling teachers’ lounges or flooding their email inboxes with solicitations.

Meanwhile, low-cost mutual funds remain buried in a sea of offerings.

Why are K-12 teachers the most vulnerable to predatory “Financial Advisors”?

Corporations have 401(k) plans. 401(k) plan participants are protected under the Employee Retirement Income Security Act of 1974 (ERISA). ERISA requires corporations and the plan sponsors to be fiduciaries and act in the best interest of participants. Participants have the right to sue if any of these guidelines are violated.

And while private schools and universities have ERISA-protected 403(b)s (and can sue if such protections are violated), public K-12 schools do not. Lack of this crucial legislation allows teachers to be preyed upon by “Financial Advisors” selling high-fee, high-commission products.

In fact, in 2021 TIAA was fined $97M by the SEC for fraudulently misleading retirees into moving their retirement investments into higher-fee accounts offered by the company. This happens every day to K-12 teachers but since K-12 403(b)s are not covered by ERISA there is nothing the SEC can do.

How much do these hidden fees matter?

It turns out fees matter a lot.

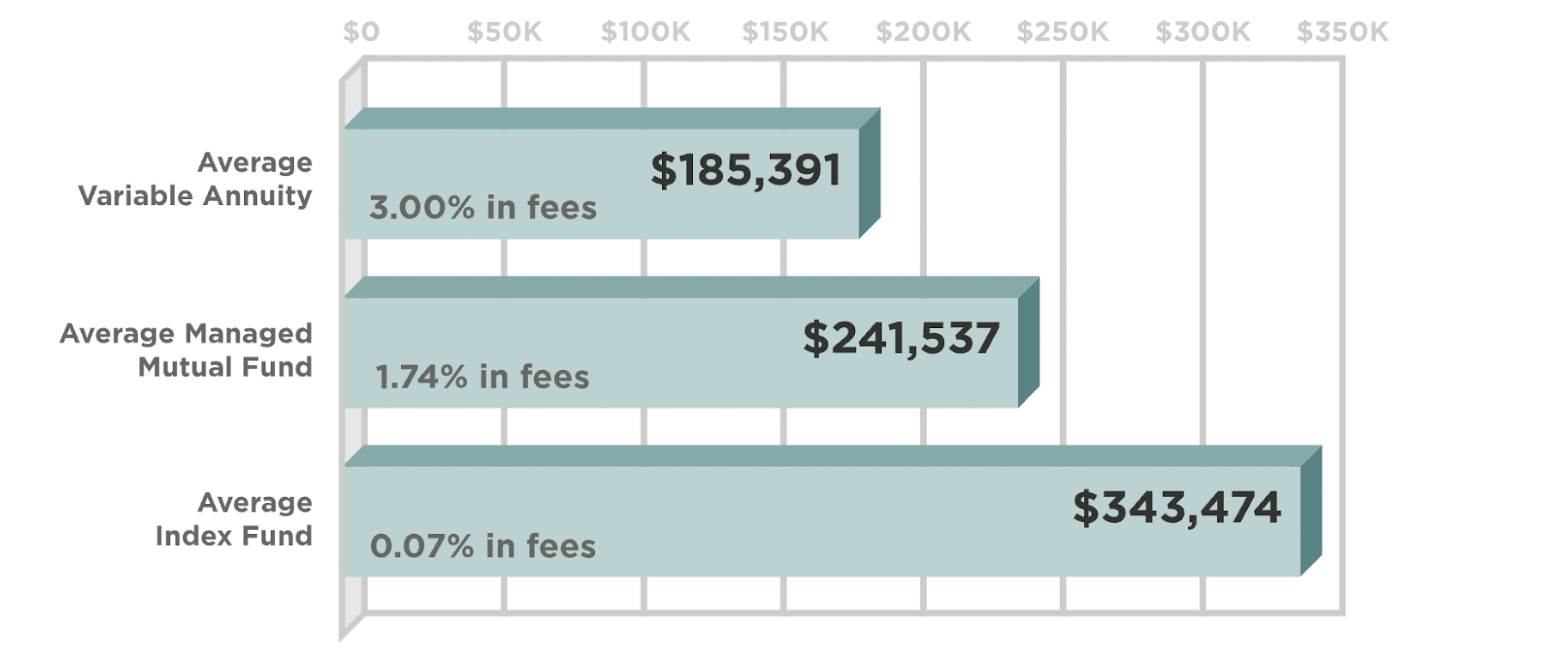

Look at the chart below that shows the huge difference 3% fees make in your retirement savings. The retirement savings with the 3% fees (typical annuity) is almost half the retirement savings with .07% fees (low cost index funds).

How High Fees Sabotage Savings

The power of compounding interest highlights how severe the consequences of being looped into a high-cost plan can be. Let’s take a look at the math.

The total value of an investment after 35 years, assuming $250 contributed monthly with a 6% average annual return:

As shown above, the total of an investment after 35 years, with a $250 monthly contribution and a 6% average annual return yields only $185,391 with a variable annuity with 3% in fees. Three percent may seem nominal, but compare that total with the average cost of an actively managed mutual fund, which is 1.74% in fees. Suddenly the retirement total is $241,537.

An even higher total results from just investing in an average index fund with a 0.07% expense ratio. The total has exponentially increased to $343,474.

In addition, annuities also have surrender fees of up to 7%. This means you must pay 7% of the total to take your money out. This is unheard of for mutual funds.

Can I get out of my annuity?

Maybe, as long as you haven’t annuitized — meaning you haven’t started collecting an income stream — but it will take a lot of work. I recommend that teachers visit the website of 403bwise, a nonprofit organization, at https://403bwise.org/education/bad-403b to get instructions specific to their annuity.

What should teachers do?

Look for low cost index funds like an S&P 500 index fund sold by Vanguard or Fidelity in your 403(b) choices.

Educate yourself about the S&P 500 and low cost index funds.

Read the articles on https://403bwise.org/.

Join the 403bwise Facebook group to ask specific questions of the over 13,000 teachers on https://www.facebook.com/groups/403bwise.

NOT FINANCIAL ADVICE

The information contained in this article is for informational purposes only and shall not be understood or construed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be. I do not accept any fees or commissions from anyone or any financial institution.

I’d love any feedback on these articles.