How Expensive is That “Free” Financial Planner?

A number of you asked why I recommended that you buy 529 College Savings Funds directly from your state's website and not through a “financial advisor” or broker (Merrill Lynch, Edward Jones). Let me show you an example using the Connecticut 529 College Savings Plan called Connecticut Higher Education Trust (CHET) that is run by Fidelity. CHET offers funds that you can buy directly from their website and also offers identical funds that are sold by financial advisors and brokers.

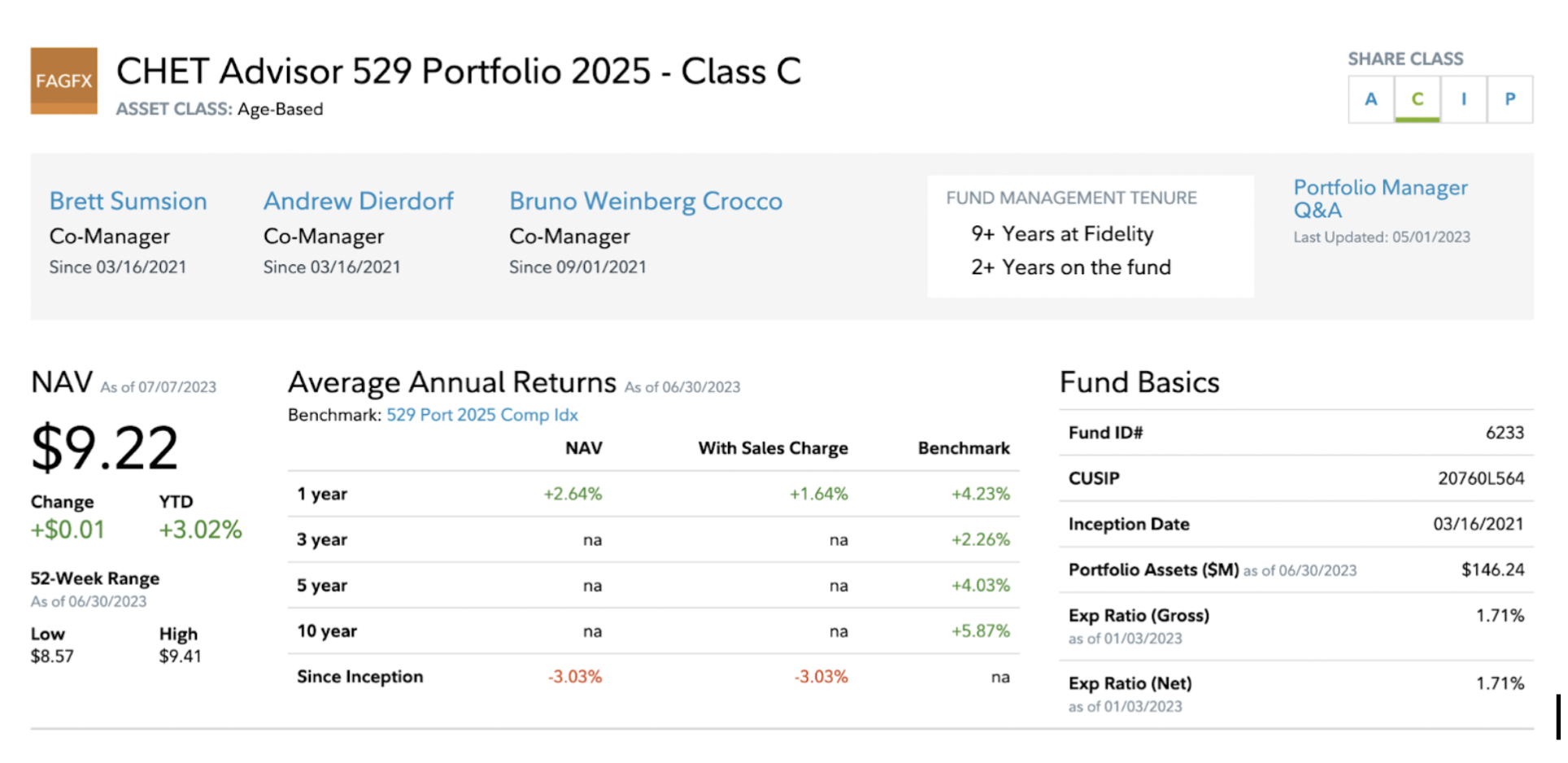

Here is the Fidelity CHET 529 Target fund sold by advisors for a student starting college in 2025:

The Average Annual Return was originally 2.64% but with the sales charge it is only 1.64%. The expense ratio is 1.71%.

Compare this to the CHET 529 Portfolio 2024 that you can buy directly from the Connecticut 529 website. The return is 3.24%. The expense is 0.62%.

Here is the CHET 529 Target fund sold directly for a student starting college in 2024:

Both funds have the same fund managers and are the same funds! However, if you buy the fund from an advisor, your return is almost 50% less than if you bought it directly from the Connecticut 529 site. This is because the advisor fund sold by a “financial advisor” pays commission annually to the advisor through 12-b1 fees that you pay as part of the fund expense.

This is why I recommend that you buy all 529 funds directly from your state’s 529 plan. They almost all have target enrollment portfolios that you don’t need a financial advisor to help you manage. You just pick the portfolio based on the year you expect your student to start school. Target enrollment portfolios are professionally managed and automatically adjust to become more conservative as your student gets closer to enrollment.

NOT FINANCIAL ADVICE

The information contained in this article is for informational purposes only and shall not be understood or construed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be. I do not accept any fees or commissions from anyone or any financial institution.

I’d love any feedback on these articles.