Risk My Retirement to Pay for a Child's College?

During one of my Retirement Optimization workshops, one of my clients asked if she should stop contributing to her retirement fund so she could save for her 15 year old’s college account. I really wished she had asked me about this 15 years ago so that she wasn’t jeopardizing her retirement.

This leads me to share a case study that I did for a couple during a 529 College Savings Planning workshop. You’ll see what a huge difference it makes if you start saving for a child’s college when they are babies.

What is a 529 College Savings Plan?

There literally is no better way to save for a child’s college than a 529 College Savings Plan.

A 529 plan is an investment account that offers tax benefits when used to pay for qualified education expenses for a designated beneficiary. You can use a 529 plan to pay for college, K-12 tuition, apprenticeship programs, and even student loan repayments. If using a 529 plan to save for college, your savings will have a minimal impact on financial aid eligibility.

How does a 529 College Savings Plan work?

Each state has its own 529 savings plan. You choose:

Which state you want to open the 529 account in

Who will be the account owner and manage the investments

Who will be the beneficiary that will use this money for college

What investment options do you want to invest this money in from a limited list of options

You can set up automatic contributions from your checking account and the money will automatically go into the account.

When it is time to pay for the beneficiary's college, the account owner uses the money in the 529 plan to pay for these expenses. In that way, the money is tax free. By contrast, if you invest in other investment vehicles, such as mutual funds, you’ll pay taxes on a portion of your annual investment earnings, plus capital gains tax when you withdraw the money.

Now let me show you the magic of compound growth using a case study that I did for a couple with a baby girl.

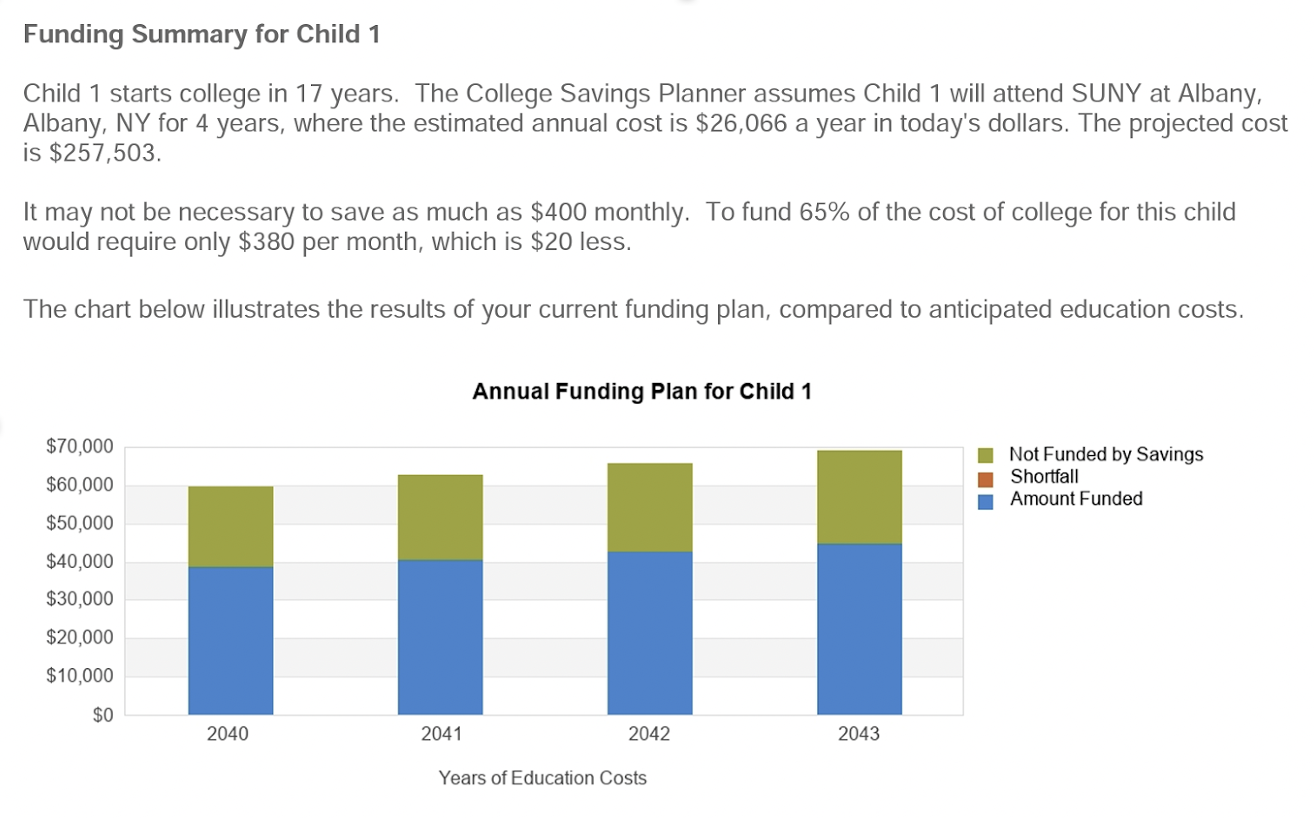

The couple had a baby girl who was a year old. They wanted to save 65% of what they would need for four years of tuition, room, and board at a New York state university, assuming they would pay in-state tuition. If they each saved $50 a week now ($100 per couple, $400 per month), they would have $135,000 when she went to college. This assumes a 6% rate of return, a 5% increase in tuition, and total tuition with room and board for four years of $257,503.

If, however, they waited until their daughter was 15 to start saving for the $135,000 (65% of the cost of a four-year New York state university), they would have to save $3,750 per month. This would severely cut into their savings for retirement.

Bottom line, if you start saving even $50 per week per person for college when a child is a baby, you don’t have to drain your retirement savings when a child goes to college. Grandparents can set up a 529 college savings plan for grandchildren and maintain control of the account.

FAQs on 529 College Plans:

Can you transfer 529 plans to another child?

Short answer: Absolutely. If the original beneficiary ends up not using the 529 plan funds, you can switch beneficiaries to another family member or relative as defined by the IRS. You can even make yourself the beneficiary if you want to go back to school for an advanced degree or even classes at a local college. For example, I had money left over in my son’s 529, so I’m letting it grow tax free and will change the beneficiary to my granddaughter and use it to pay for her college.

What happens to unused 529 funds?

Your 529 account will never expire, even if your child ends up not using it. You can leave the funds in the account, allowing investments to grow tax-deferred, and use the funds down the road for a grandchild or another qualified family member.

Is a 529 worth it if not used for education?

It's best if the funds in a 529 plan are used for education because of the benefits this type of account provides. If you end up withdrawing unused 529 funds and don't use them for qualified education expenses, you will likely owe federal and state taxes plus a 10% penalty on the earnings portion of the withdrawal.

Will a 529 savings hurt our financial aid award?

The FAFSA (Free Application for Federal Student Aid) only counts the savings in a 529 plan at 5.64%. So, for example, 529 savings in the amount of $10,000 would only reduce a student’s aid award by $564. The benefit of saving for their education far outweighs that,

What if the beneficiary wants to spend their 529 money on a fancy car instead of college?

Unlike an UTMA (Uniform Transfers to Minors Act) account, in which the beneficiary gains access to the money when they turn 18, the 529 account owner decides what the money will be used for. The beneficiary does not have access to this money.

What if I set up a 529 plan in my state but my child wants to go to a college in another state?

Unlike prepaid college tuition plans, a 529 college fund can be used for college tuition in any state.

How do I find the 529 plan for my state?

You can use this link to find the 529 plans sold by your state: https://www.collegesavings.org/find-my-states-529-plan/.

WATCH OUT: Do not pick Advisor Sold Savings Plans. These are the exact same plans you can buy yourself but an extra fee tacked on every year.

NOT FINANCIAL ADVICE

The information contained in this article is for informational purposes only and shall not be understood or construed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be. I do not accept any fees or commissions from anyone or any financial institution.

I’d love any feedback on these articles.