Is This Really a Great Medicare Employer Retiree Benefit?

Are the Medicare retiree benefits provided by your employer or union better than traditional Medicare? We all want to sign up for Medicare plans that are subsidized by employers or unions, right?

Not so fast! Read on to learn how to make an educated decision that is in your best interest.

“Super Medicare Advantage” Plans May Seem Tempting

Employers and unions may offer what I call “Super Medicare Advantage” plans. These are not the typical Medicare Advantage plans that an individual might get from Medicare.gov.

To show you what I mean, I’ll compare the specifics of the IBM Retiree Medicare Advantage Plan and the Connecticut Retired Teachers Medicare Advantage plan, both offered by UnitedHealthcare (the largest U.S. insurer, by revenue), to traditional Medicare with a Plan G Supplement.

Out of Network Coverage

The big advantage with these “Super Medicare Advantage” plans is how they handle Out of Network coverage. They are Preferred Provider Organization (PPO) plans which allow you to see any provider — in- or out-of-network — at the same share of the cost, as long as the provider is eligible to participate in the Medicare program. That’s a big difference from the typical Medicare Advantage plans.

However, according to an article in the April, 7, 2024 New York Times, UnitedHealthcare has reaped about $1 billion in fees annually by paying only a fraction of out-of-network medical provider bills. Although the promise of out-of-network coverage sounds good, patients could be on the hook for the unpaid bills.

In addition, UnitedHealthcare requires “Prior Authorization” for many medical services.

What is Prior Authorization?

You may be familiar with “Prior Authorization.” When patients try to schedule procedures or fill prescriptions at a pharmacy, they may be told that their insurance company won’t pay for the procedure or medication unless the patient’s physician obtains approval from the insurance company in advance. This may result in patients waiting days, weeks, or even months for a necessary test or medical procedure. This tactic, used by insurance companies to control costs, is called Prior Authorization.

Prior Authorization policies are also used to kick elderly patients out of Skilled Nursing Facilities because their Medicare Advantage plans will authorize only a certain number of days to save costs. I wrote about this in My Mom's Experience with Medicare.

How is UnitedHealthcare’s track record with Prior Authorizations?

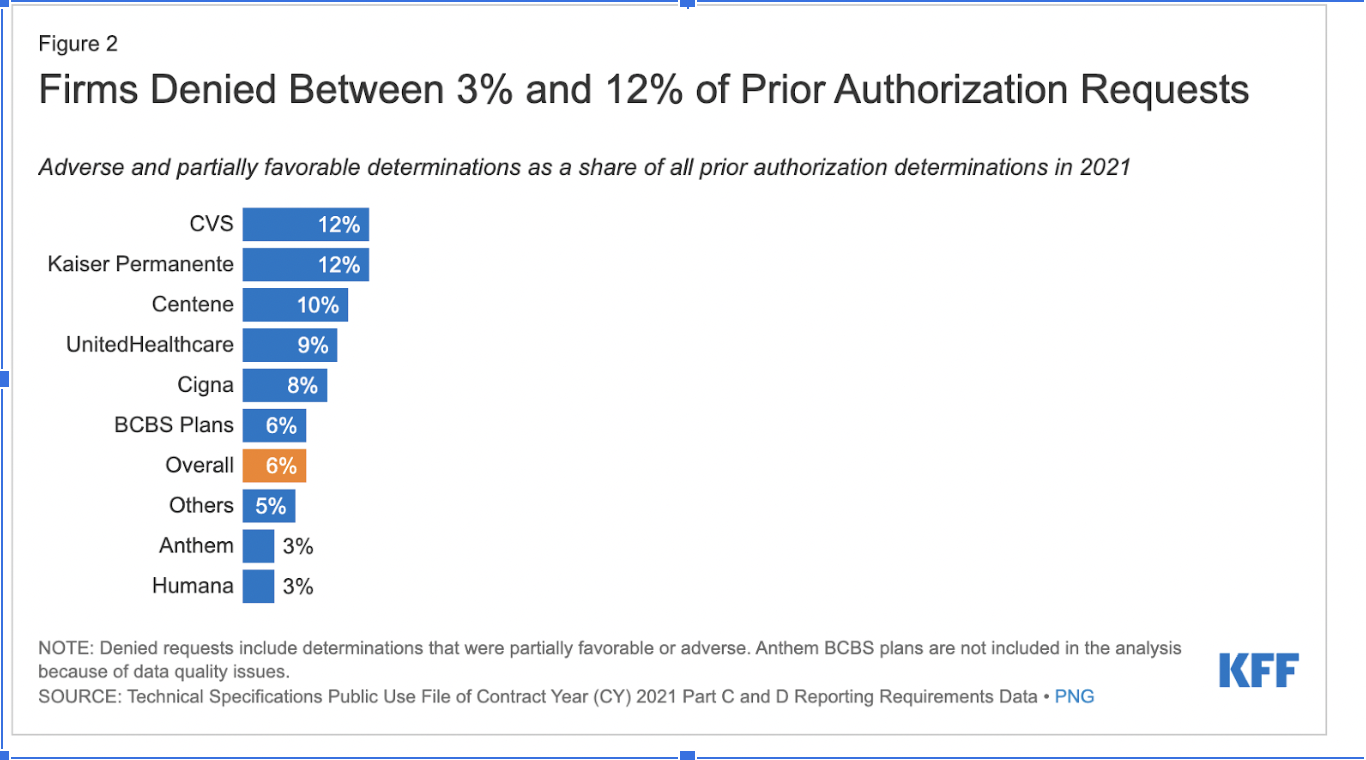

UnitedHealthcare denies 9% of Prior Authorizations.

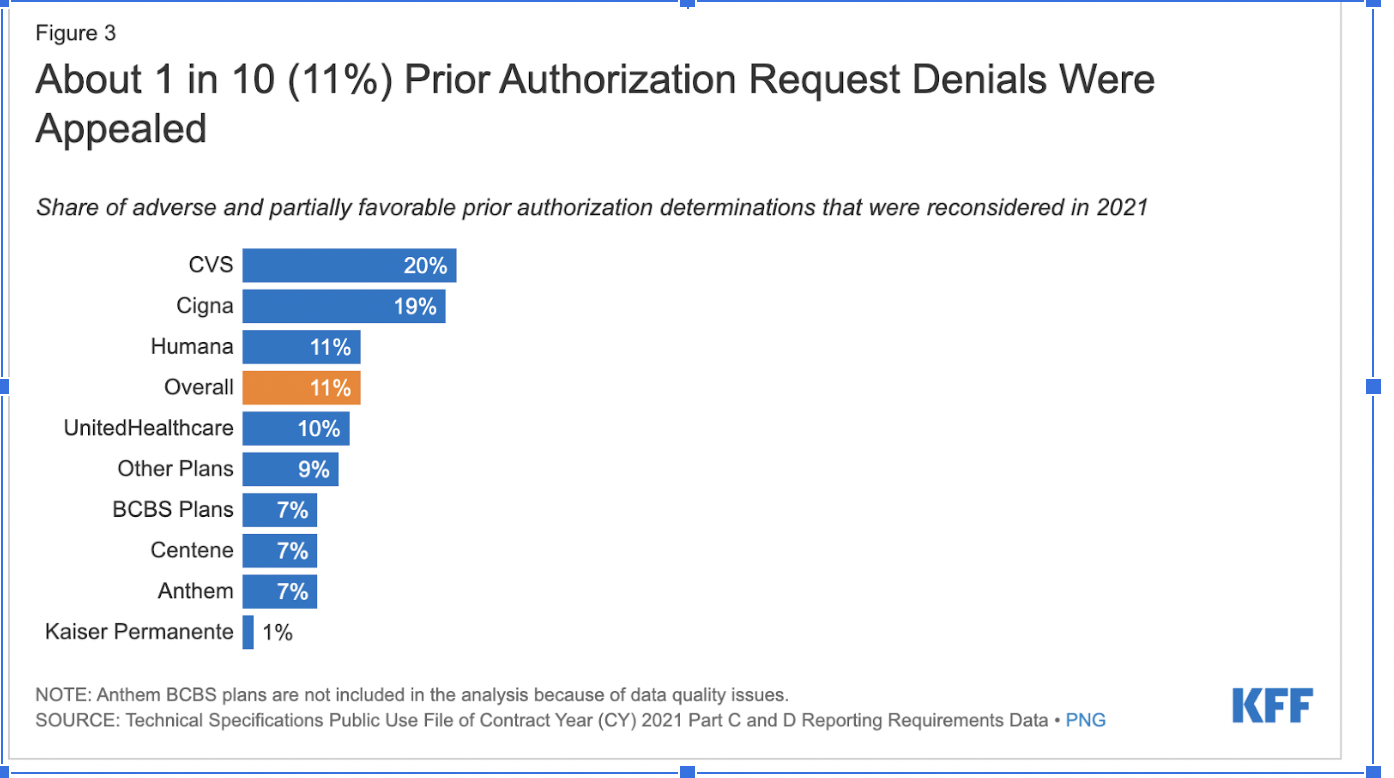

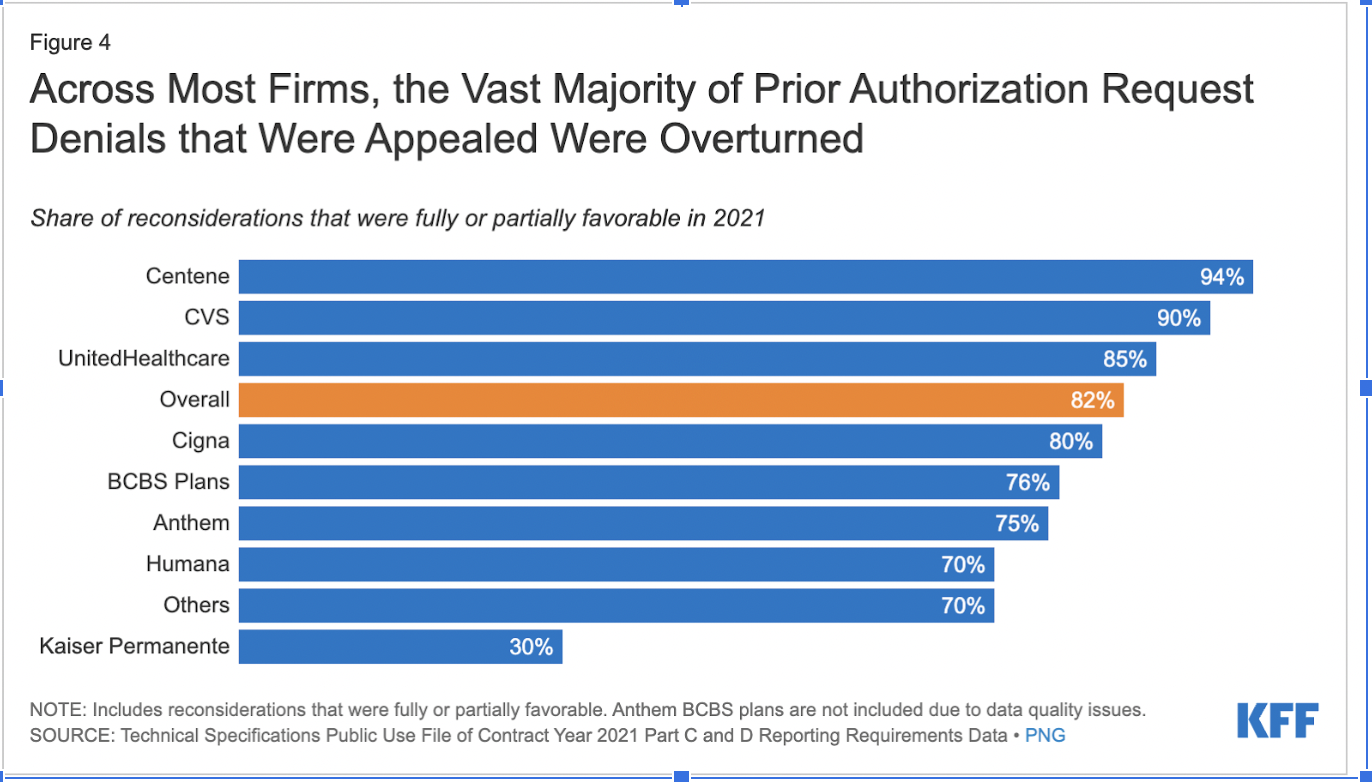

Physicians spend an enormous amount of time fighting these Prior Authorization rejections to get patients the therapies that they need. Insurance companies are well aware that appealing is an arduous process — patients appeal only about 11% of Prior Authorization Denials (UnitedHealthcare’s denial rate is 10%). Insurance companies know they can save money by initially denying coverage for services they should cover. When patients do appeal, 82% of the denials are overturned (UnitedHealthcare’s overturn rate is 85%).

UnitedHealthcare Medicare Advantage is now being sued for using faulty AI to deny elderly patients medically necessary coverage. The lawsuit, filed in federal court in Minnesota, claims that UnitedHealthcare illegally denied "elderly patients care owed to them under Medicare Advantage plans" by using an AI model known by the company to have a 90% error rate, overriding determinations made by the patients' physicians that the expenses were medically necessary.

“The elderly are prematurely kicked out of care facilities nationwide or forced to deplete family savings to continue receiving necessary medical care, all because [UnitedHealthcare’s] AI model ‘disagrees’ with their real live doctors’ determinations,” according to the complaint.

Case Study: “Super Medicare Advantage” vs. Traditional Medicare

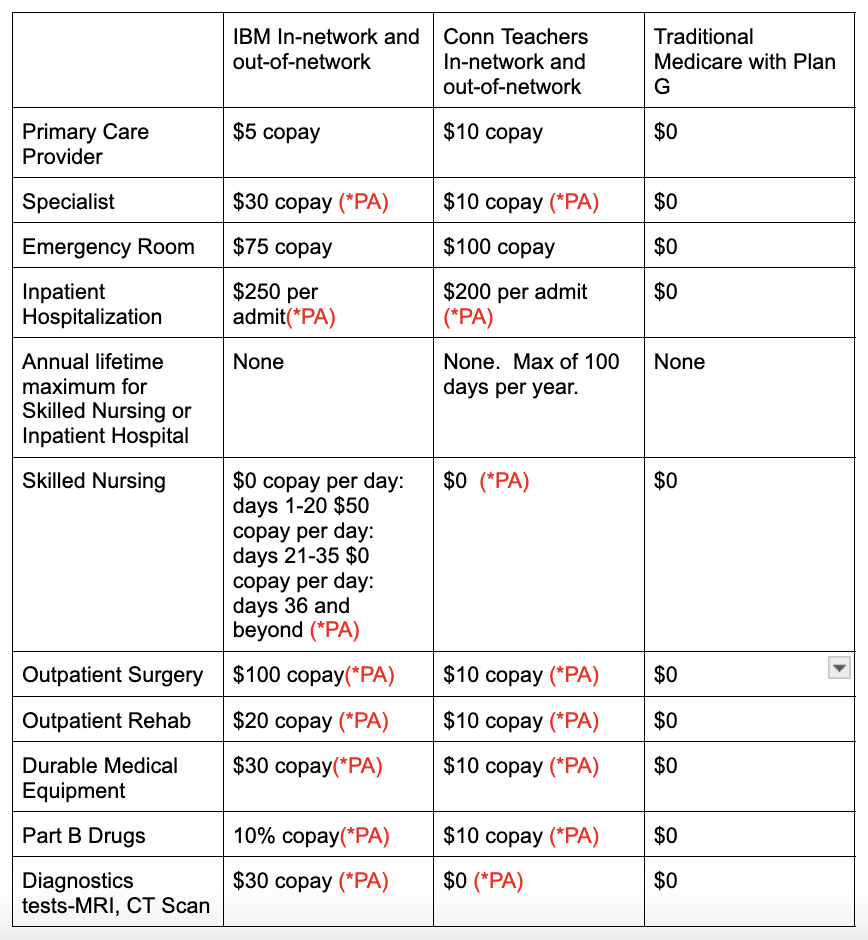

Let's compare these “Super Medicare Advantage” plans to traditional Medicare with a Medicare Supplement G plan (the best) plus a drug plan. Let’s look at the plans to see what requires prior approval (*PA).

A) IBM: Corporate subsidized UnitedHealthcare® Group Medicare Advantage (PPO) Enhanced

Keep in mind that the IBM subsidy (Future Health Account Fund) is only accessible when you enroll in one of the new IBM-sponsored Group Medicare Advantage plan options. See plan here.

B) Connecticut Teachers Retirement Board: Union subsidized UnitedHealthcare® Group Medicare Advantage (PPO)

This Medicare Advantage plan is subsidized by the Union. See plan here.

C) Traditional Medicare with a Medicare Supplement Plan G for a 65-year-old non-smoking woman residing in Florida

Medicare Supplement Plan G is the most popular Medicare Supplement Insurance plan available to any Medicare member. Plan G covers certain expenses such as coinsurance, copayments, and deductibles that aren't covered under Medicare Part A and Part B, also known as Original Medicare. Medicare Supplement Plan G covers “gaps” in Medicare coverage: the out-of-pocket costs left over after Medicare pays its portion of the bill. Plan G covers more of these costs than any other Medicare Supplement Insurance plan available to new Medicare members. To learn more about Medicare Supplement plans, read my article What to Know Before You Buy a Medicare Supplement.

Monthly Cost

Keep in mind that all three of these plans require a monthly payment of $174.70 for Part A and Part B Medicare. With the Medicare Advantage plans, you no longer have original Medicare. With Medicare Advantage, the Federal Government pays UnitedHealthcare over $1,000 a month per enrollee.

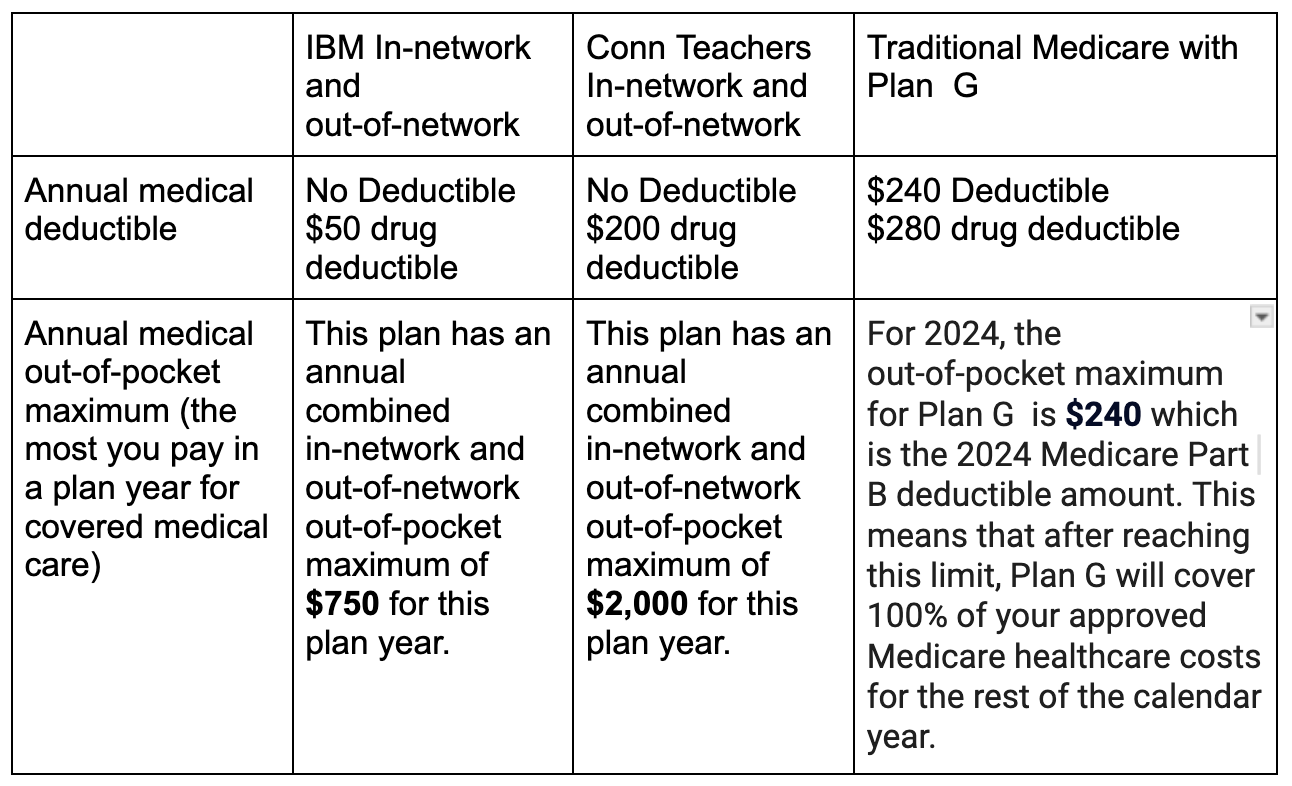

Deductible

Medical Benefits (PA* = prior authorization)

Additional Benefits Not Provided by Medicare

What Medicare Plan am I going to choose when I’m 65?

“Super Medicare Advantage” plans are cost effective plans with Out-of-Network coverage

Both UnitedHealthcare’s IBM Retiree Medicare Advantage Plan and the Connecticut Teachers Retiree Medicare Advantage Plan are cost effective plans. Their big advantage over typical Medicare Advantage Plans is that they allow you to go out of United Healthcare’s network for hospitals and doctors. In addition, your out-of-pocket expenses are also very low.

The downsides are:

The insurance company may use Prior Authorizations to limit your ability to have doctor-authorized procedures or limit the length of a stay at a skilled nursing facility.

Patients could be on the hook for the unpaid portion of out-of-network provider bills.

That’s not worth the cost savings to me.

IBM retirees may forfeit Future Health Account funds if they don’t choose these plans.

IBM retirees also need to consider that their Future Health Account funding (that converts to HRA when you turn 65) can only be used to pay for the IBM Retiree Plan (before 65) or this IBM Medicare Advantage Retiree plan (after 65). IBM retirees forfeit the Future Health Account funding (HRA) if they don’t use it for either of these two plans.

You may not be able to switch to traditional Medicare after 65.

You also need to take into account that if you are not a resident of New York, Connecticut, Massachusetts, or Maine, you may not be able to switch to a Medicare Supplement plan when you are older or ill. In all other states, a Medicare Supplement plan can deny you coverage or charge you triple for preexisting conditions. To learn more about this, read my article What They Don't Tell You About Medicare Advantage.

Where does that leave me?

Since I am not a resident of one of these four states, I know that the plan that I choose during the initial enrollment period at 65 is the plan that I will have for the rest of my life. My priority is to choose a plan that will allow me to choose the best facilities and doctors if I’m really sick, without the wait or denial of Prior Authorizations. I want my healthcare decisions to be between my doctor and me, and not governed by a for-profit insurance company. I’m willing to forgo the Medicare Advantage extras such as dental and vision coverage or gym membership. I’m also willing to pay a higher premium to ensure that I have the best medical and drug coverage. In my opinion, traditional Medicare with a Plan G Supplement is simply a fantastic medical health insurance plan.

What will I do first?

First, I will schedule an appointment with Medicare consultant Gene Ranney (941-716-4348) to analyze which is the best Medicare Supplement plan for me. Gene helped my brother and sister-in-law choose the best Medicare Supplement plan and drug plan for them. I will select the best Medicare Supplement category (currently G) and choose the company that he recommends. He will also do an analysis of the best drug plan for me based on my medications and where I like to purchase them. I know that unlike with the Medicare Supplement plan, I can switch drug plans every year.

This is a big and complicated decision. I wanted to show you the comparison so you can make a Medicare decision that is in your best interest. Everyone’s situation is different and each choice has trade offs.

Feel free to email me at lucretiaryan@financialfreedomforwomen.org with any questions.

NOT FINANCIAL ADVICE

The information contained in this article is for informational purposes only and shall not be understood or construed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be. I do not accept any fees or commissions from anyone or any financial institution.

I’d love any feedback on these articles.