"Surprise! Your Medicare Coverage Isn’t Guaranteed—Here’s What You Need to Know"

It’s crucial to make the right Medicare choice when you turn 65, as this decision can impact your healthcare access and quality for the rest of your life. It may be harder than you think to switch from Medicare Advantage to Original Medicare when you really need better healthcare. I want you to understand what Insurance companies will ask you if you try to apply for a Medicare Supplement Plan (Medigap) after the initial Medicare enrollment period at 65.

Limited Options for Switching Later

Many people don’t realize that switching from Medicare Advantage to Original Medicare with a Medigap (Supplement) plan isn’t always possible once you’re older and may have developed serious health issues. Medicare Advantage plans can restrict access to certain specialists and hospitals or deny care altogether, so people often want to switch to Original Medicare when they need more comprehensive care or have been denied care. But this switch can be difficult or impossible if certain pre-existing conditions are present.

Research Highlights: Obstacles to Getting a Medigap Plan from Insurance Companies

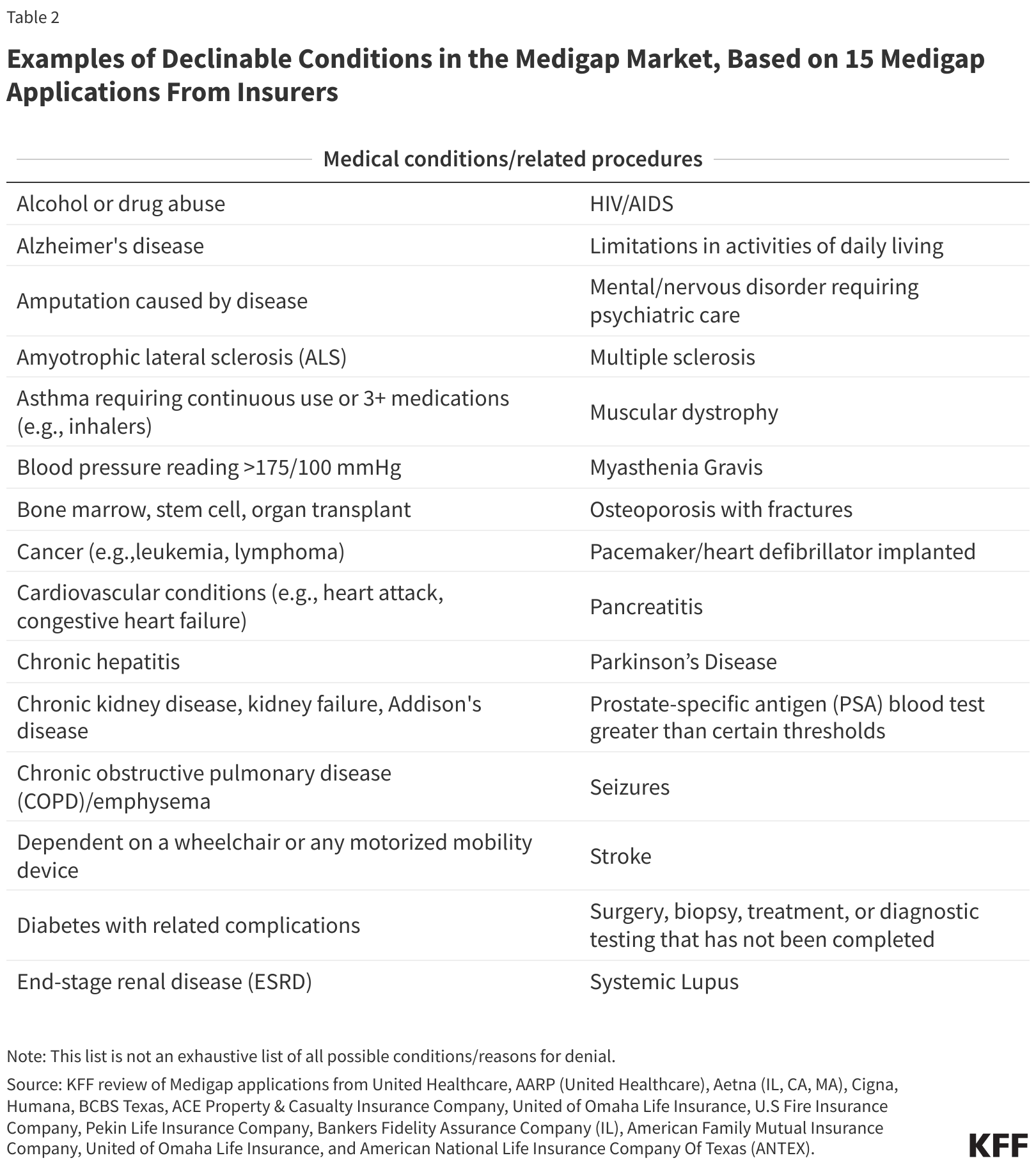

A recent review by the Kaiser Family Foundation (KFF) of Medicare Supplement applications from major insurance companies highlights the barriers people face when they try to switch from a Medicare Advantage Plan to a Medicare Supplement .

Reasons you could be denied coverage:

Medical Conditions

Many Medigap insurers list specific conditions that can lead to denial, including Alzheimer’s disease, asthma that requires use of inhalers, cancer, congestive heart failure, diabetes with complications (e.g., neuropathy), ESRD, high blood pressure, and stroke (Table 2). Conditions like these are common among Medicare beneficiaries—about 67% have high blood pressure, 26% have diabetes, and 19% have chronic kidney disease. Insurers often also deny applicants who have had major procedures, such as organ transplants or pacemaker implants. Below are some additional examples

Functional Limitations

Some applications note that difficulty performing daily activities, dependence on a wheelchair, or being homebound may be grounds for denial.

Medications

Lists of medications can lead to application denial, including high doses of insulin, Zestril for blood pressure, Revlimid for cancer, and others. For instance, one insurer’s application advises, “if the applicant has taken any of the following [medications] in the past 12 months, do not submit the application.”

Unaddressed Medical Advice

Many applications ask if you’ve been advised to undergo treatment, testing, or surgery that you haven’t completed. If so, this could be a reason for denial.

Medical Service Use

Certain uses of medical services, such as recent home health care, inpatient hospitalizations, or stays in nursing facilities, may also disqualify applicants.

Some applications even explicitly advise, “if the answer to any question is yes, do not submit the application.” While a few policies allow coverage at higher premiums for less severe conditions, serious health issues can still prevent coverage entirely.

Choosing Medicare Advantage at 65 without understanding these restrictions can leave you without options when you need comprehensive care later on.

Only New York, Connecticut, and Massachusetts residents are protected

Only residents of New York, Connecticut, and Massachusetts are guaranteed the right to buy a Medicare Supplement plan after age 65, regardless of preexisting conditions. Additionally, in these states, you don’t need to wait for the annual enrollment period—you can switch to a Medicare Supplement plan at any time during the year.

For more insight, read my article published in The Humble Dollar on my mother’s experience with Medicare and Medicare Advantage, which illustrates how her Medicare choice impacted her life.

My goal is to help you make an educated Medicare choice that serves your best interests—not those of the insurance companies—while you still have options.

NOT FINANCIAL ADVICE

The information contained in this article is for informational purposes only and shall not be understood or construed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be. I do not accept any fees or commissions from anyone or any financial institution.

I’d love any feedback on these articles.